Introduction

Mutf_In: Sbi_Equi_Hybr_Vuwazq: SBI Equity Hybrid Fund Regular Growth is a mutual fund that deals with equity and other investments mentioned above. SBI Mutual Fund, an AMC respected and adored in India introduced it. As a fund, it seeks to offer its investors a synchronized approach to building wealth in equities and debt instruments.

Fund Overview

- Fund Type: Open-ended Hybrid Fund

- Launch Date: December 9, 1995

- Fund Size: As of my last update, the fund size was substantial, but for the most current figure, please check the latest factsheet

- Fund Managers: The equity portion is managed by Dinesh Balachandran, and the Debt portion by Dinesh Ahuja (names may have changed since my last update)

More funds from SBI Mutual Fund

| Fund name | AUM (in Crs.) | 1Y | 5Y |

| SBI Multi Asset Allocation Fund | ₹5,866 Crs | 25.54% | 16.09% |

| SBI Retirement Benefit Fund – Aggressive Hybrid Plan | ₹1,532 Crs | 25.40% | N.A. |

| SBI Equity Savings Fund | ₹5,044 Crs | 15.85% | 12.86% |

| SBI Conservative Hybrid Fund | ₹10,007 Crs | 14.60% | 12.34% |

| SBI Retirement Benefit Fund – Conservative Hybrid Plan | ₹277 Crs | 16.13% | N.A. |

Investment Objective

The main objective of the SBI Equity Hybrid Fund Regular Growth is to produce long-term capital gratitude and current income from a collection financed by equity and debt securities in a reasonable combination.

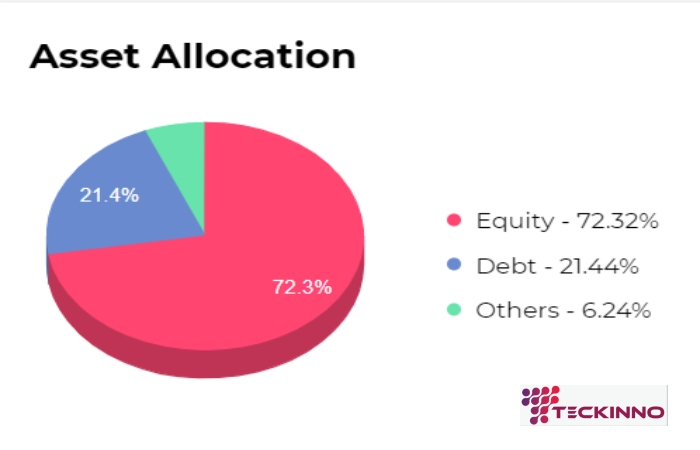

Asset Allocation

- Equity and Equity-related instruments: 72.32%

- Debt instruments (including securitized debt): 21.44%

- Others 6.24%

Investment Strategy

The fund employs a balanced strategy:

- Equity Portion: Focuses on companies with strong growth potential across market capitalizations

- Debt Portion: Invests in high-quality fixed-income securities to provide stability and regular income

Concentration & Valuation Analysis

| Jul-24 | Jun-24 | May-24 | Apr-24 | Mar-24 | Feb-24 | |

| Number of Holdings | 72 | 73 | 72 | 72 | 69 | 71 |

| Top 5 Company Holdings | 27.49% | 28.26% | 27.72% | 27.33% | 26.46% | 28.34% |

| Top 10 Company Holdings | 46.05% | 47.69% | 47.67% | 46.08% | 45.05% | 47.52% |

| Company with Highest Exposure | Reliance Industries (6.08%) | Reliance Industries (6.46%) | GOI (5.78%) | ICICI Bank (7.4%) | ICICI Bank (7.16%) | ICICI Bank (7.11% |

| Top 3 Sector Holdings | 37.30% | 39.00% | 39.21% | 40.38% | 39.03% | 38.50% |

| Top 5 Sector Holdings | 47.66% | 51.28% | 50.07% | 50.78% | 49.31% | 49.32% |

| Sector with Highest Exposure | (22.78%) | (24.28%) | (23.94%) | (24.77%) | (23.36%) | (23.68%) |

Risk Profile

The fund is considered to have a temperately high-risk profile due to its essential contact with equity markets. Though, debt is necessary to mitigate some of this risk.

Risk & Volitility

- Alpha: 0.14%

- Beta: 1.08

- Sharpe Ratio: 0.88

- Std Deviation: 8.96%

- Tracking Error: 4.06%

Benchmark

CRISIL Hybrid 35+65 – Aggressive Index

Key Features

- Diversification: Offers exposure to both equity and debt markets

- Professional Management: Managed by experienced fund managers

- Flexibility: It improves the features of the financial position of the company through an active management of the equity-debt ratio by the fund manager, depending on market conditions.

- Tax Efficiency: In as much as these products have various attributes, for tax purposes, the fund is placed within the equity fund category where the equity proportion reaches or goes above 65%.

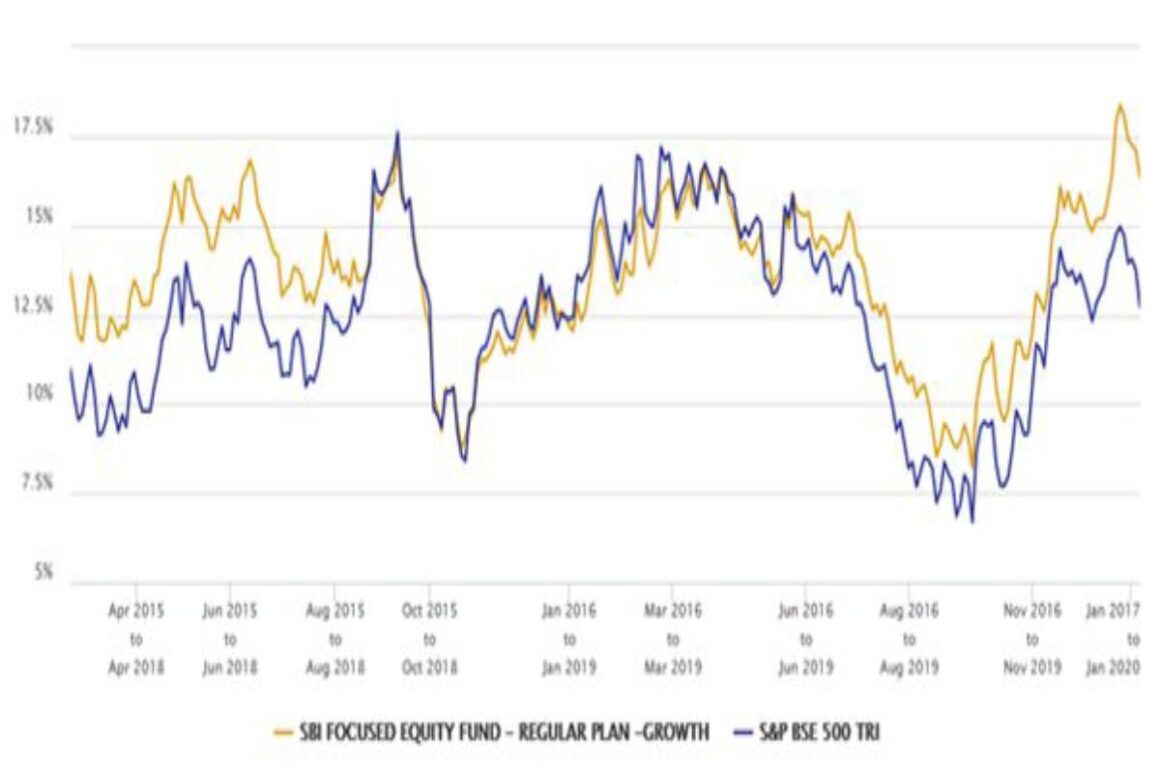

Performance

Performance can differ over time. Investors should check the latest handout for up-to-date performance data. Generally, the fund is expected to deliver:

- Capital appreciation through its equity component

- Stability and regular income through its debt component

Expense Ratio

The expense ratio for the regular plan is typically higher than the direct plan. For the most current expense ratio, please refer to the latest fund documents.

Who Should Invest

This fund may be suitable for:

- Investors with a moderately high-risk appetite

- People who wish to invest in a diversified company that has both equity and debt Instruments.

- Persons who have a liberal investment time frame of not less than five years.

How to Invest

Slightly risk seeking investors

- People who want to have their investment diversified in equities as well as debts.

- Five-year plus investors (those who will not be selling their investments in the short term)

Taxation

- Capital gains realized from the sale of listed securities and other assets held for more than a year are taxed at 10% on the gains exceeding Rs 1 lakh in a financial year

- • Turbo charges for short-term capital gains where the assets were sold within 1 year, 15% of the Omega.

Top Stock Holdings Companies

| Company | Sector | Assest(%) | P/E | EPS-TTM(₹) | RETURN 1 YR(%) |

| Reliance Industries | Energy | 6.08 | 29.1 | 101.6 | 15.63 |

| ICICI Bank | Financial | 549.00% | 1801.00% | 6591.00% | 2489.00% |

| State Bank of India | Financial | 525.00% | 1051.00% | 7728.00% | 4174.00% |

| Bharti Airtel | Communication | 5.1 | 90.12 | 16.46 | 73.26 |

| HDFC Bank | Financial | 4.2 | 18.22 | 89.6 | 2.6 |

| Solar Industries India | Chemicals | 407.00% | 10270.00% | 10222.00% | 14140.00% |

| Interglobe Aviation | Services | 361.00% | 2114.00% | 20236.00% | 7429.00% |

| Divi’s Laboratories | Healthcare | 3.37 | 73.49 | 63.06 | 26.79 |

| MRF | Automobile | 3.31 | 27.97 | 4865.43 | 26.29 |

| Bajaj Finance | Financial | 3.07 | 27.33 | 241.14 | -3.9 |

Conclusion

SBI Equity Hybrid Fund Regular Growth can be described as a scheme that may be of interest to middle-income earners who want their money to grow. However, they do not want to take a very high risk. As is usually the case with any investment strategy, however, it would be wise to factor in some of your goals and also check on your ability to lose money, and if you so wished, you could meet an advisor.